Excitement About Virtual Cfo In Vancouver

Table of ContentsThe smart Trick of Vancouver Tax Accounting Company That Nobody is DiscussingThe Best Strategy To Use For Cfo Company VancouverRumored Buzz on Cfo Company VancouverSmall Business Accountant Vancouver Can Be Fun For AnyoneRumored Buzz on Vancouver Accounting FirmThe Buzz on Tax Accountant In Vancouver, Bc

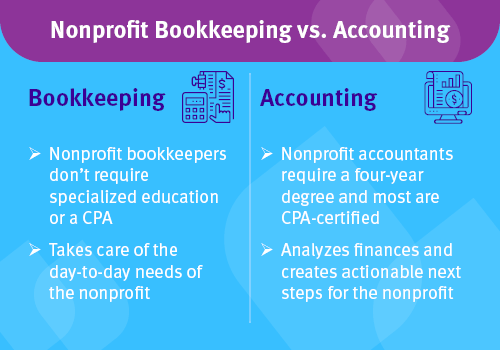

Right here are some advantages to working with an accountant over a bookkeeper: An accountant can offer you a comprehensive sight of your organization's monetary state, together with methods and also suggestions for making economic choices. Bookkeepers are just accountable for tape-recording economic deals. Accountants are called for to complete even more schooling, accreditations and also job experience than bookkeepers.

It can be challenging to determine the proper time to employ an accountancy specialist or bookkeeper or to determine if you require one whatsoever. While many tiny businesses work with an accountant as a specialist, you have numerous options for handling economic tasks. As an example, some small company owners do their own bookkeeping on software application their accountant advises or makes use of, giving it to the accountant on a weekly, month-to-month or quarterly basis for activity.

It might take some history study to locate a suitable bookkeeper due to the fact that, unlike accounting professionals, they are not called for to hold a professional accreditation. A strong recommendation from a trusted coworker or years of experience are crucial factors when hiring an accountant.

Rumored Buzz on Tax Consultant Vancouver

For local business, adept cash administration is a vital facet of survival and also development, so it's important to collaborate with an economic specialist from the beginning. If you favor to go it alone, think about starting with audit software application as well as maintaining your publications diligently approximately day. In this way, should you require to work with an expert down the line, they will certainly have presence right into the complete monetary history of your company.

Some source meetings were performed for a previous variation of this write-up.

Examine This Report about Virtual Cfo In Vancouver

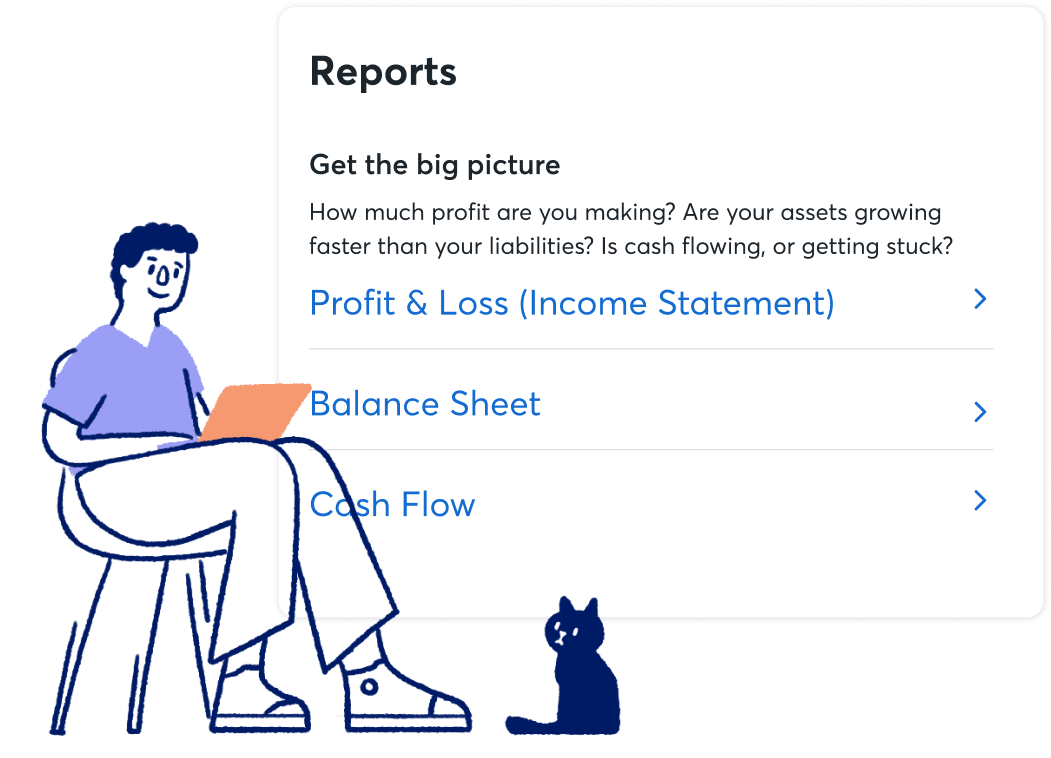

When it concerns the ins and outs of tax obligations, accountancy and money, however, it never harms to have an experienced professional to resort to for assistance. An expanding variety of accountants are additionally dealing with points such as capital forecasts, invoicing as well as human resources. Eventually, a lot of them are handling CFO-like functions.

When it came to using for Covid-19-related governmental funding, our 2020 State of Small Business Study located that 73% of small company proprietors with an accountant claimed their accountant's guidance was necessary in the application procedure. Accountants can also aid entrepreneur prevent pricey errors. A Clutch survey of small company proprietors shows that greater than one-third of tiny services list unpredicted costs as their leading financial obstacle, followed by the blending of company and also personal finances and the lack of ability to receive settlements on schedule. Tiny company proprietors can expect their accountants to assist with: Choosing the organization structure that's right for you is necessary. It affects just how much you pay in taxes, the documents you require to file as well as your individual liability. If you're seeking to convert to a various organization structure, it might result in tax repercussions and various other issues.

Even companies that are the very same dimension and market pay extremely various quantities for accountancy. These costs do not convert into cash money, they are essential for running your service.

The Of Tax Accountant In Vancouver, Bc

The average price of accounting solutions for tiny business differs for each distinct circumstance. The typical monthly bookkeeping charges for a little business will certainly increase as you add more services and also the jobs obtain tougher.

For instance, you can tape purchases and also procedure pay-roll making use of on-line software. You get in amounts right into the software, and also the program calculates totals for you. In many cases, pay-roll software program for accounting professionals enables your accountant to supply payroll handling for you at very little additional expense. Software application remedies can be found in all forms as well as sizes.

What Does Tax Consultant Vancouver Mean?

If you're a new entrepreneur, do not neglect to variable accountancy expenses right into your budget. If you're an expert owner, it may be time to re-evaluate accountancy expenses. Management prices and accountant fees aren't the only accountancy expenditures. small business accountant this content Vancouver. You ought to additionally take into consideration the effects accounting will certainly have on you as well as your time.

Your capability to lead employees, serve customers, and make decisions could suffer. Your time is also important as well as must be taken into consideration when taking a look at bookkeeping prices. The time invested on bookkeeping jobs does not create earnings. The less time you invest in accounting as well as taxes, the more time you have to grow your company.

This is not intended as legal guidance; to learn more, please click on this link..

All about Outsourced Cfo Services

:max_bytes(150000):strip_icc()/accountingperiod_definition_0929-20fc49a7325e4ce7b4975caca2683c1e.jpg)

:max_bytes(150000):strip_icc()/Accounting-FINAL-e01e0f2d93264a989c19357a99d7bffd.jpg)

:max_bytes(150000):strip_icc()/accounting-cycle-4202225-55b4e93d325f490aa6e7bd3a13fd1304.jpg)